The last few years have been anything but dull in retail electricity. The energy crisis sent prices into the stratosphere in 2022 and although the market has since calmed, uncertainty remains. Variability in generation, weather phenomena and shifts in consumption have reshaped the landscape in ways not seen before. Consumers now track the day-ahead spot price like a stock price and suppliers are working hard to stay competitive in a game where margins are compressing and customer expectations keep rising.

On windy hours it is now common to receive a phone notification saying power is cheap and it is a good time to run the washing machine or heat the sauna. Electricity prices have become an everyday talking point boosted by attention-grabbing headlines. At the same time suppliers are complementing traditional contracts with an expanding range of value-added services. Some are closely linked to consumption and some are adjacent to power altogether such as solar PV installations or home insurance. The product shelf has widened and alongside fixed-price offers there is a growing set of more complex pricing models that require greater customer understanding to compare. In tougher competition small local retailers often struggle to compete with larger players and many have already exited the market.

Where are we now and above all where is the market heading?

And how can Spring Advisor help your company succeed in an increasingly complex playing field?

Prices have swung widely. The energy crisis pushed them temporarily to extreme levels while the growing share of variable renewable generation especially wind and solar will continue to add short-term volatility. Exceptional weather events and rising demand from data centers, hydrogen production, and broader electrification keep price development difficult to predict. Further out potential new Nordic nuclear capacity and additional interconnection could bring more stability but that is still some way off.

Consolidation is accelerating. It is getting harder for smaller suppliers to compete with larger ones in an environment where brand recognition, system efficiency, and customer scale are critical. The largest players already serve a significant share of the market and the trend points to further concentration. M&A activity has been strong in recent years and transaction valuations have clearly risen after the energy crisis. Spring Advisor has advised on multiple sector transactions on both the buy-side and the sell-side. We acted as advisor to Oomi in its merger with Lumme Energia which created the largest electricity retailer in Finland. We have also advised on many other comparable transactions and conducted comprehensive market studies for several companies in the sector. The common thread across all mandates is focused value creation and a deep understanding of energy market dynamics.

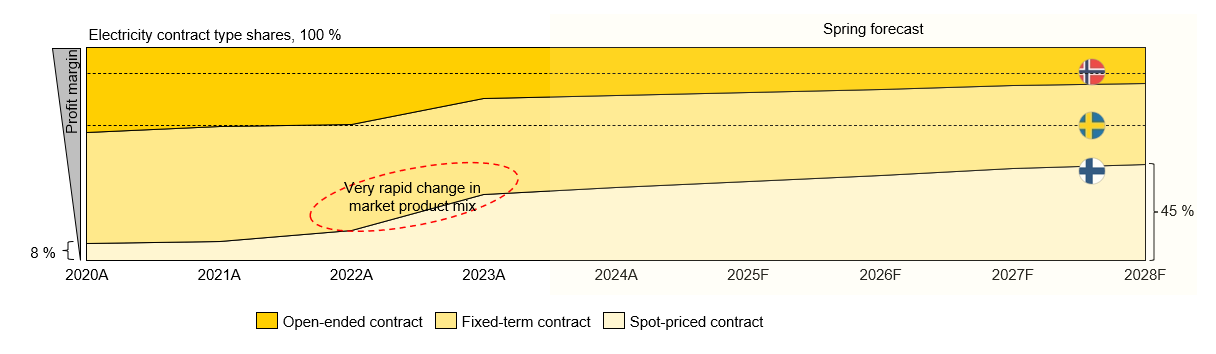

The energy crisis turned many of us into power nerds. Consumers have become more price aware and the share of spot-priced contracts has increased rapidly as customers monitor prices closely and switch more actively. Spot-priced contracts are particularly low margin for suppliers and their rise has tightened profitability across the sector. In Finland, the share has climbed quickly, partly from a low base. In Norway, spot-priced contracts have long exceeded 90 percent and Finland is now moving rapidly toward the same model where spot-priced electricity becomes the default choice for households. The risk linked to price volatility has shifted more strongly from suppliers to consumers. The electricity bill is no longer a smooth monthly payment. It can feel like everyday betting against the weather forecast.

As core retail margins have shrunk, companies are turning to value-added services. Suppliers increasingly offer products that create incremental value and importantly, better margins. Guarantees of origin, solar PV, and electric vehicle charging solutions have grown fast and many portfolios now include entirely new categories such as employee bike schemes or mobile phone contracts. These products often have significantly better margins than basic power supply. Developing and operating such services fits better with larger players whose customer bases enable efficient scaling and cost-effective product development. For smaller companies, value-added services may sometimes be less critical, especially where a strong local position supports slightly higher pricing and sufficient margin in the core business.

How Spring Advisor can help?

At Spring Advisor, we don’t promise a crystal ball. We offer sharp analysis, a current market view, and an experienced team that has worked on numerous strategic transactions in the sector. Our completed acquisitions, divestments, and studies show how we deliver tangible value for clients.

Whether you are seeking growth through M&A, repositioning in a changing market, designing a customer-centric value-added strategy, or preparing for regulatory change we know where the market is and how to get you to the outcome you want.